KRA PIN Application Process Step By Step

Kenya Revenue Authority PIN also known as KRA PIN is mandatory for all tax payers in Kenya One must make an application with KRA itax to get the KRA PIN. The KRA PIN enables one to be able to file monthly or annual tax returns of an individual. It is also a mandatory document while trying to access some services in Kenya. Such services may includes; Opening a bank account, application of a tender, registering of a business or company, seeking employment, applying for helb loan among other activities.

One may not be able to transact in above mentioned fields if they lack a valid KRA PIN. Some of the above services may also require one to have a KRA clearance certificate from KRA. You cannot apply for the KRA clearance Certificate if you lack the KRA pin in the first place.

Requirements for KRA PIN Application

For one to be able to apply for a KRA PIN, one must have the following;

- National Identity Card (ID)

- Email Address

- Phone Number

- Postal Address

These details are mandatory while applying for a KRA PIN. Make sure the Email address you provide is an active one as you will need to verify it before you can be able to generate a KRA PIN

Also Read:How to get your p9 form and file tax returns

KRA Pin Application Procedure

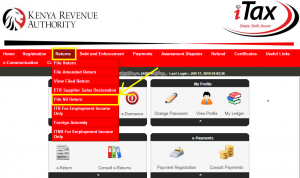

- Log into the KRA itax website

- Select new PIN Registration

- Click ‘Apply for a PIN’

- Enter your level of Education

- Enter your ID number

- Enter your ID day, month and year of birth

- Enter your Postal Address

- Enter your Email Address

- Select ‘Send OTP’

- Check your Email to get the OTP password and enter it into the system

- Give your phone Number

- Select ‘Income tax Individual resident if you are a Kenyan Citizen’

- Give details of your income sources

- Make sure all the mandatory fields have been filled

- Enter the value of a simple arithmetic

- Click ‘Submit’

- Download the E-generated PIN

- Another copy of your KRA Pin with your Password will be send to your Email.

- Log In for the First time to with your New KRA PIN

- Enter the password you received on your Email.

- Change the password by entering a new password

- Confirm your New Password

- Choose your secrete question and Word

- Submit

That’s it. By following these steps you will be able to generate a KRA PIN. This process Can easily be done by an individual provided you have a computer and you are connected to the internet. Your KRA PIN will be on the right Corner of the downloaded document. It is usually quoted as. AXXXXXXXXXXXXV.

Also Read:Guide to Filing KRA ITAX Returns

Where Can I get the Application Services?

To be able to generate a KRA PIN you can do it on your own using a computer, you can get the services from a Cyber assistant or you can Visit the nearest KRA offices to make the application. Huduma Centres also have KRA desk that offers the services.

KRA PIN Application For Sole Proprietors and Companies

If you have an individual Company you are supposed to apply for a KRA PIN for you to be able to file your company returns. A KRA PIN for a company will enable the company to be able to able to qualify for certain transactions such as, purchase of property, apply for tenders, open a bank account with the Company name and filing company returns.

To be able to apply for a KRA PIN for your company, you will need to have the following information.

- KRA PIN For one of the Company’s directors

- Company details and details of the director

- Physical Address

- Postal Address

- Email Address

- Phone Number

- Business type

- Commencement date

For individual holders of a KRA PIN, its is a requirement to file your annual Tax returns every year between the first day of the month of January to the last date of the month of June. Failure to do so attracts a penalty from the Kenya Revenue Authority.

If you do not have any source of income, it is still mandatory that you file Nil returns.

Also Read:First Time HELB Loan Application Process and Requirements