How to check your KRA Status and Penalties

KRA has made it mandatory for all Kenyans to file returns each year or each time depending on your tax category. With many not aware if they have any outstanding penalties or fine it is important to always check your KRA tax status. It is also important to confirm your itax status after making the KRA tax payment.

In this article we shall look at some of the ways you can use to check your current status on the returns you filed and you will also be able to confirm if the KRA tax payment you made has reflected in the KRA tax portal.

How to check your KRA Tax status

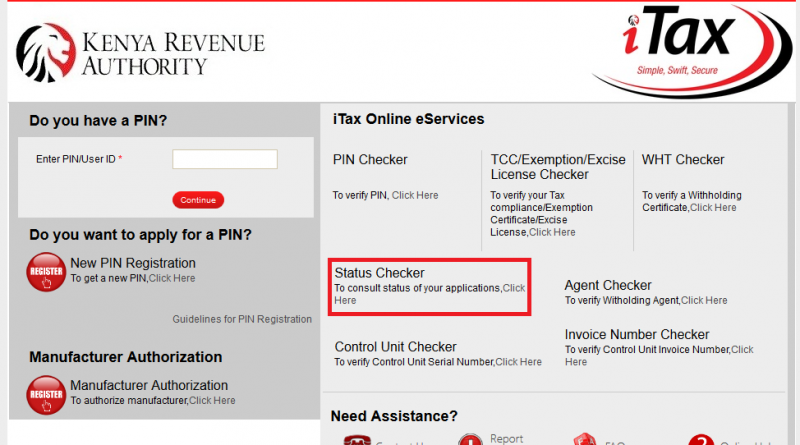

The KRA portal is designed with the option to help individuals check their tax status under the ‘Status Checker’ which allows the taxpayers to check upto date tax status with KRA. This option allows taxpayer can check the status of Registration, Payment, Return and status of the problem reported to KRA.

Requirements for checking your payment status

To be able to check your payment status you will need the following

- Payment Registration Number (PRN)

At the top of each and every KRA Payment Slip is what we refer to as the Payment Registration Number or in simple term PRN. Basically, the Payment Registration Number serves as the account number when you are making Payments to Kenya Revenue Authority either using M-PESA, Bank, Cheque or even RTGS.

- Search Code

Search code is usually located in the middle of the KRA Payment Slip and it is used to query the status of your KRA Payment Slip on iTax Portal using the KRA Status Checker. Combined with the Payment Registration Number (PRN), these two allows a taxpayer check, consult and confirm KRA Payments Status on iTax Portal.

How to make Payments to KRA and check The payment status

KRA has made it possible for taxpayers to make payment for the taxes and check their tax status using the tax checker application.

KRA Payment Options

You can pay your Taxes using the KRA Paybill number 572572 or make a direct bank deposit,Cheque or RTG

Requirements for making KRA Payment

To be able to make the KRA payment, there are two main important requirements needed to make KRA Payments in Kenya i.e. KRA Payment Slip and M-PESA Mobile Number.

- KRA Payment Slip

The first requirement is normally the KRA Payment. You will first need to apply for Payment Registration, Generate the KRA Payment Slip and then use the Payment Slip’s Payment Registration Number (PRN) as the account number when you are making the payment to Kenya Revenue Authority (KRA). Without the KRA Payment Slip, you will not be able to make any KRA Payments on iTax Portal.

Also Read:How to get your p9 form and file tax returns

- Your M-Pesa Mobile Number

If you have opted for the mobile payment method, all you need is to have an M-PESA Mobile Number. M-PESA makes it easier and flexible to make KRA Payments quickly and easily. You will use the KRA Paybill Number 572572 to make KRA Payment and the Payment Registration Number (PRN) will serve as the account number.

How to check your KRA Payment status Using KRA Status Checker

- Log into KRA itax portal

- Click on Status Checker that fall under iTax online eServices

- Under case type select payment

- Enter the payment registration number (PRN)

- Enter the KRA search code as displayed on the KRA payment Slip

- Go on and solve the arithmetic question (Security Stamp)

- Click Consult button

- The result of the payment status will then will pre presented on the Payment Status on iTax

- On the Results Page of the KRA Status Checker, you will see different columns including: Payment Registration Number (PRN), Firm/Taxpayer Name, Applicant Type, Payment Date, Tax Obligation, Amount (Kshs)/Payment Utilization, Status, WHT VAT Number, Payment Slip, Revenue Booking Slip and Is PRN Used by MoL.

- To know your Payment status see the Status column.

- Received status is a confirmation that your payment was received by KRA

- Registered status may imply that you have generated the KRA Payment Slip but have not made any payments

That’s it. The payment method to use before getting the payment Slip entirely depends on the taxpayer. You can choose to pay vial bank ,Cheque, RTG or Mpesa to get your payment Slip.

Also Read:Guide to Filing KRA ITAX Returns

How to cheque your Status Under Nil returns

If you usually file your nil returns you can as well check and determine if you have any penalties.

To check your status

- Log into your KRA iTax portal

- Go to waiver and penalties

- Fill in the details to be able to know it you have any penalties to pay

Each year you are required to file your returns for the previous year between the months of January to the last date of the month of June.